Unlock purchasing power and rewards with a credit card

It’s time you earned points for all of your spending. We have the perfect credit card to help you Score BIG!

Benefits You’ll Love

- Swipe and tap your way to rewards points with each purchase

- No annual fees or balance transfer fees

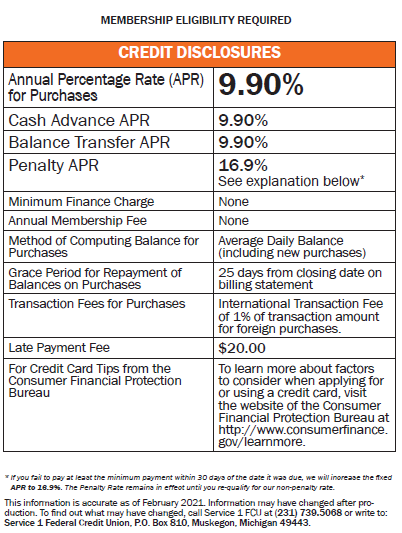

- Enjoy rates as low as 9.9% APR*

- Convenient cash advances for last-minute needs

- Rates as low as 9.9% APR*

- NO ANNUAL FEE

- No balance transfer fees

- No cash advances fees

- Competitive rewards

- True 25-day grace period for new purchases (if your previous credit card statement balance was paid in full)

- Easily replaced if lost or stolen.

- Turn cards on and off on-the-go using Card Controls in the Service 1 FCU mobile app

- Purchasing power across the globe, in stores and online. Use your secured or unsecured credit card for everyday expenses like gas, groceries, or monthly bill payments, and more!

- Various convenient payment options

To activate your Service 1 FCU credit card, call 800-543-5073. If you have questions, contact us!

*APR=Annual Percentage Rate. Subject to credit approval. Rates and terms are subject to change. Membership eligibility required. For complete details, contact Service 1 Federal Credit Union.

Score rewards when you carry a secured or unsecured Service 1 FCU credit card! Earn points with every new purchase, redeemable for gift cards or statement credits, travel, merchandise, and more.

Enroll, earn, and score Rewards! Log into your Service 1 FCU account in online banking, select your credit card, and choose “View Your Rewards” to see your points balance and learn more about rewards options. Not yet an online banking user? Create an account today!

Check out popular points redemption options below.

MEMBER FAVORITE | Redeem points at checkout:

Pay with Points in Store or at the Pump

SAVE at checkout with ScoreCard Rewards Premium Payback! Cardholders have the option to redeem points for discounts at the point-of-sale when transacting with participating merchants like Walmart, Walgreens, CVS, Dollar General, and more! † The list is always growing.

Get $0.50 off per gallon (up to 20 gallons) by redeeming your ScoreCard Rewards points at the pump!† Redeem and save at one of over 30,000 participating fuel stations like Shell, CITGO, Murphy USA, and more.

- Pay with your ScoreCard Rewards credit card at participating vendors

- Select “yes” at checkout to redeem points

- Enjoy savings on your purchase!

Pay with Points Online Using PayPal

Apply points in real-time while checking out with PayPal by linking your Service 1 FCU credit card to your PayPal account. † Here’s how it works:

- Checkout with PayPal when shopping online

- Select your Service 1 FCU ScoreCard Rewards Credit Card as your payment method and check “Use ScoreCard Rewards Points”

- Enter the number of points you’d like to apply to your purchase and enjoy the savings!

Learn more about linking to PayPal here.

†Instant savings (Premium Payback) available in-store at cashier for select retailers and at the pump for select gas stations; points must be available in account for redemption.

Check out more popular rewards options:

Statement Credits (like cash back!)

Redeem points for statement credits to lower the balance of your Service 1 FCU credit card account! Please remember to submit your normal minimum monthly payment before the next due date.

Gift Cards

Choose from a wide selection of gift cards for popular restaurants, gas stations, retailers, entertainment, and more. Most common values range from $10 to $500 and various options in between. You’re sure to find something you love!

Merchandise

Redeem points for a variety of merchandise. Whether you’re looking for home goods, electronics, sports equipment, jewelry and accessories, or office supplies, ScoreCard Rewards is sure to have something for everyone.

Travel & Experiences

Book your trip and SAVE with ScoreCard travel rewards! Redeem points for dream vacation necessities like luggage, flights, rental cars, hotels, experiences, and more!

Gifting

Feeling generous? Gift your points to other cardholders OR make a donation to a local charitable organization!

A secured credit card is a credit card funded by you. Using your Service 1 FCU savings account, deposit the amount you’re comfortable spending; that deposit can be used as collateral for the purchases made with the credit card. If you’re just starting out or looking to rebuild your credit, a secured card can help you establish credit safely and securely. Meet with one of our Certified Credit Union Financial Counselors to discuss how we can help you achieve your financial goals!

An unsecured credit card does not require a savings deposit. Limits for unsecured credit cards are determined by factors like credit score and repayment history.

Both secured and unsecured credit cards have the same low rate and are eligible for ScoreCard Rewards!

Not sure which card is right for you? Contact us to discuss which option will best serve you and your financial goals!

A voluntary insurance program, Debt Protection* coverage can eliminate your eligible loan balance, up to the agreement maximum, should the unthinkable happen before paying off your loan. Situations in which debt protection can benefit you or your family:

Death | Debt Protection can eliminate your eligible loan balance, up to the agreement maximum, should you pass away before paying off your loan.

Disability (due to a protected illness or injury) | Debt Protection can cancel your monthly loan payment, up to the agreement maximum. With payment cancellation, both the principal and interest portions of your loan payment are cancelled, up to the agreement maximum, and your loan balance declines.

Involuntary Unemployment | If you become involuntarily unemployed, Debt Protection coverage can defer the principal portion of your loan payment and cancel the interest portion up to the agreement limit. With interest cancellation, the loan balance does not decline. Program and other fees may continue to accrue.

With Debt Protection, you'll purchase just enough protection to cover your loan balance. Ask today for the coverage that'll bring you peace of mind!

Already have a Service 1 FCU Credit Card, but aren’t sure if your loan is protected? Contact us today to review your account, check your point balance, and add debt protection today!

*Subject to change

*APR=Annual Percentage Rate. Subject to credit approval. Rates and terms are subject to change. Membership eligibility required. Bonus rewards promotional periods determined by ScoreCard Rewards and vary by offer. Log into ScoreCard Rewards account for complete details or contact Service 1 Federal Credit Union.

Your purchase of Debt Protection with Life Plus is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative or refer to the Member Agreement for a full explanation of the terms of Debt Protection with Life Plus. You may cancel the protection at any time. If you cancel protection within 30 days, you will receive a full refund of any fee paid.

Apply Now

Not Yet a Member?

Apply for a low-rate loan now and open your membership later.

Apply NowCheck Membership EligibilityUse this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly dividends earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term Share Certificate can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total dividends earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Kasasa Cash*

| Balance | Minimum Opening Deposit | Dividend Rate | APY** |

|---|---|---|---|

| 0 - $10,000 | $0 | 3.20% | 3.25% |

| $10,000+ | $0 | 0.05% | 3.25% to 0.34% |

| All balances if qualifications not met | $0 | 0.05% | 0.05% |

*Qualifications

Earning the full rewards is so easy, you're probably already doing it! To earn your rewards, simply use your Kasasa Cash account with the following activities and transactions each monthly qualification cycle:

- Have at least 12 debit card purchases post and settle

- Be enrolled in and receive e-statement notices

- Be enrolled and log in to online banking

If you don't meet the qualifications one month, don't worry. There is no penalty, and you still have a free checking account that earns our base interest rate. Plus, you can get back to earning really high interest and nationwide ATM fee refunds the very next month.

Kasasa Saver*

| Balance | Minimum Opening Deposit | Dividend Rate | APY** |

|---|---|---|---|

| 0 - $25,000 | $0 | 0.50% | 0.50% |

| $25,000+ | $0 | 0.05% | 0.50% to 0.14% |

| All balances if qualifications not met | $0 | 0.05% | 0.05% |

*Qualifications

Qualifying for Kasasa Cash or Cash Back rewards automatically qualifies you for the highest Kasasa Saver rate, too. Simply use your Kasasa Cash or Cash Back account with the following activities and transactions each monthly qualification cycle:

- Have at least 12 debit card purchases that post and settle

- Be enrolled in and receive e-statement notices

- Be enrolled and log in to online banking

It's no problem if you miss a qualification cycle. Both accounts are still free and earn our base interest rate. And you can get back to earning rewards the very next month you qualify.

Loans

| Loan Type | Rates Starting at:* |

| Auto | 4.99% APR |

| Motorcycle | 4.99% APR |

| Boat/Camper/RV | 4.99% APR |

| Recreational Vehicles | 5.99% APR |

| Personal Loan | 7.99% APR |

| Personal Line of Credit | 18.00% APR |

| Credit Cards | 9.9% APR |

| Home Mortgage | Call for current rates |

| Home Equity Loan (fixed) | 6.49% APR1 |

| Home Equity Line of Credit (variable) | 8.50% APR2 |

* APR=Annual Percentage Rate. Rates and terms subject to change at any time without notice. Rate based on credit score and history. Please contact Service 1 FCU for more information.

1HOME EQUITY: APR = Annual Percentage Rate. Rates based on credit worthiness, term, and combined loan-to-value (CLTV) ratio. CLTV must be 80% or less. Credit is subject to approval, not all applicants will qualify. A home equity loan is secured by a first or second mortgage lien on your home, not all properties may qualify for financing. The minimum loan amount is $10,000, and the maximum loan amount is $150,000. Fees and closing costs may apply. Flood and/or property hazard insurance may be required. Other restrictions may apply. Membership eligibility required. Contact Service 1 FCU for complete details. All Service 1 FCU loan programs, rates, terms and conditions are subject to change at any time without notice. Service 1 FCU NMLS #441347.

2HOME EQUITY LINE OF CREDIT (HELOC): APR = Annual Percentage Rate. The prime rate is the highest prime rate published in the Money Rates Table of The Wall Street Journal on the last business day of each quarter. Prime is a variable rate; as it changes, the APR on your account will also change. The APR will be based on the prime rate plus a margin of up to 3.5%. Rates based on credit worthiness, term, and combined loan-to-value (CLTV) ratio. CLTV must be 80% or less. The APR is variable for the life of the loan and can range from as low as 4.00% APR to a maximum of 18%. Credit is subject to approval, not all applicants will qualify. A home equity line of credit is secured by a first or second mortgage lien on your home, not all properties may qualify for financing. The minimum line of credit amount is $10,000, and the maximum amount is $150,000. Fees and closing costs may apply. Flood and/or property hazard insurance may be required. Other restrictions may apply. Membership eligibility required. Contact Service 1 FCU for complete details. All Service 1 FCU loan programs, rates, terms and conditions are subject to change at any time without notice. Equal Housing Lender. Service 1 FCU NMLS #441347.

Loans - 1

| Loan Type | Rates Starting at:* |

|---|---|

| Auto | 4.99% APR |

| Motorcycle | 4.99% APR |

| Boat/Camper/RV | 4.99% APR |

| Recreational Vehicles | 5.99% APR |

| Personal Loan | 7.99% APR |

| Personal Line of Credit | 18.00% APR |

| Credit Cards | 9.9% APR |

| Home Mortgage | Call for current rates |

| Home Equity Loan (fixed) | 4.99% APR1 |

| Home Equity Line of Credit (variable) | 4.75% APR2 |

* APR=Annual Percentage Rate. Rates and terms subject to change at any time without notice. Rate based on credit score and history. Please contact Service 1 FCU for more information.

1HOME EQUITY: APR = Annual Percentage Rate. Rates based on credit worthiness, term, and combined loan-to-value (CLTV) ratio. CLTV must be 80% or less. Credit is subject to approval, not all applicants will qualify. A home equity loan is secured by a first or second mortgage lien on your home, not all properties may qualify for financing. The minimum loan amount is $10,000, and the maximum loan amount is $100,000. Fees and closing costs may apply. Flood and/or property hazard insurance may be required. Other restrictions may apply. Membership eligibility required. Contact Service 1 FCU for complete details. All Service 1 FCU loan programs, rates, terms and conditions are subject to change at any time without notice. Service 1 FCU NMLS #441347.

2HOME EQUITY LINE OF CREDIT (HELOC): APR = Annual Percentage Rate. The prime rate is the highest prime rate published in the Money Rates Table of The Wall Street Journal on the last business day of each quarter. Prime is a variable rate; as it changes, the APR on your account will also change. The APR will be based on the prime rate plus a margin of up to 3.5%. Rates based on credit worthiness, term, and combined loan-to-value (CLTV) ratio. CLTV must be 80% or less. The APR is variable for the life of the loan and can range from as low as 4.00% APR to a maximum of 18%. Credit is subject to approval, not all applicants will qualify. A home equity line of credit is secured by a first or second mortgage lien on your home, not all properties may qualify for financing. The minimum line of credit amount is $10,000, and the maximum amount is $100,000. Fees and closing costs may apply. Flood and/or property hazard insurance may be required. Other restrictions may apply. Membership eligibility required. Contact Service 1 FCU for complete details. All Service 1 FCU loan programs, rates, terms and conditions are subject to change at any time without notice. Equal Housing Lender. Service 1 FCU NMLS #441347.

Money Management Account

| Balance | APY** |

| $100,000+ | 2.00% |

| $50,000.00 - $99,999.99 | 1.75% |

| $20,000.00 - $49,999.99 | 1.25% |

| $2,000.00 - $19,999.99 | 1.00% |

Money Management Account 1

| Balance | APY |

|---|---|

| $100,000+ | 2.00% |

| $50,000.00 - $99,999.99 | 1.75% |

| $20,000.00 - $49,999.99 | 1.25% |

| $2,000.00 - $19,999.99 | 1.00% |

Share Certificates

| Term | Minimum Balance | APY** |

|---|---|---|

| 6 months - FEATURED RATE | $500 | 3.75% |

| 12 months | $500 | 3.50% |

| 18 months | $500 | 3.50% |

| 24 months | $500 | 3.50% |

| 30 months | $500 | 3.50% |

| 36 months | $500 | 3.50% |

| 48 months | $500 | 3.50% |

| 60 months | $500 | 3.50% |

Penalties may apply for early withdrawals. IRA Certificates not available in 6-month term.

Share Certificates - 1

| Term | Minimum Balance | APY |

|---|---|---|

| 6 months - FEATURED RATE | $500 | 4.75% |

| 12 months | $500 | 4.50% |

| 18 months | $500 | 3.00% |

| 24 months | $500 | 3.00% |

| 30 months | $500 | 3.25% |

| 36 months | $500 | 3.25% |

| 48 months | $500 | 3.25% |

| 60 months | $500 | 3.50% |

Penalties may apply for early withdrawals. IRA Certificates not available in 6-month term.

Youth Certificates

| Term | Minimum Balance | APY** |

| 6 months - FEATURED RATE | $50 | 4.00% |

| 12 months | $50 | 3.75% |

| 24 months | $50 | 3.75% |

Youth Certificates 1

| Term | Minimum Balance | APY** |

|---|---|---|

| 6 months - FEATURED RATE | $100 | 4.75% |

| 12 months | $100 | 4.50% |

| 24 months | $500 | 3.00% |